JPMorgan Chase (JPM) 2024 Q1 profit

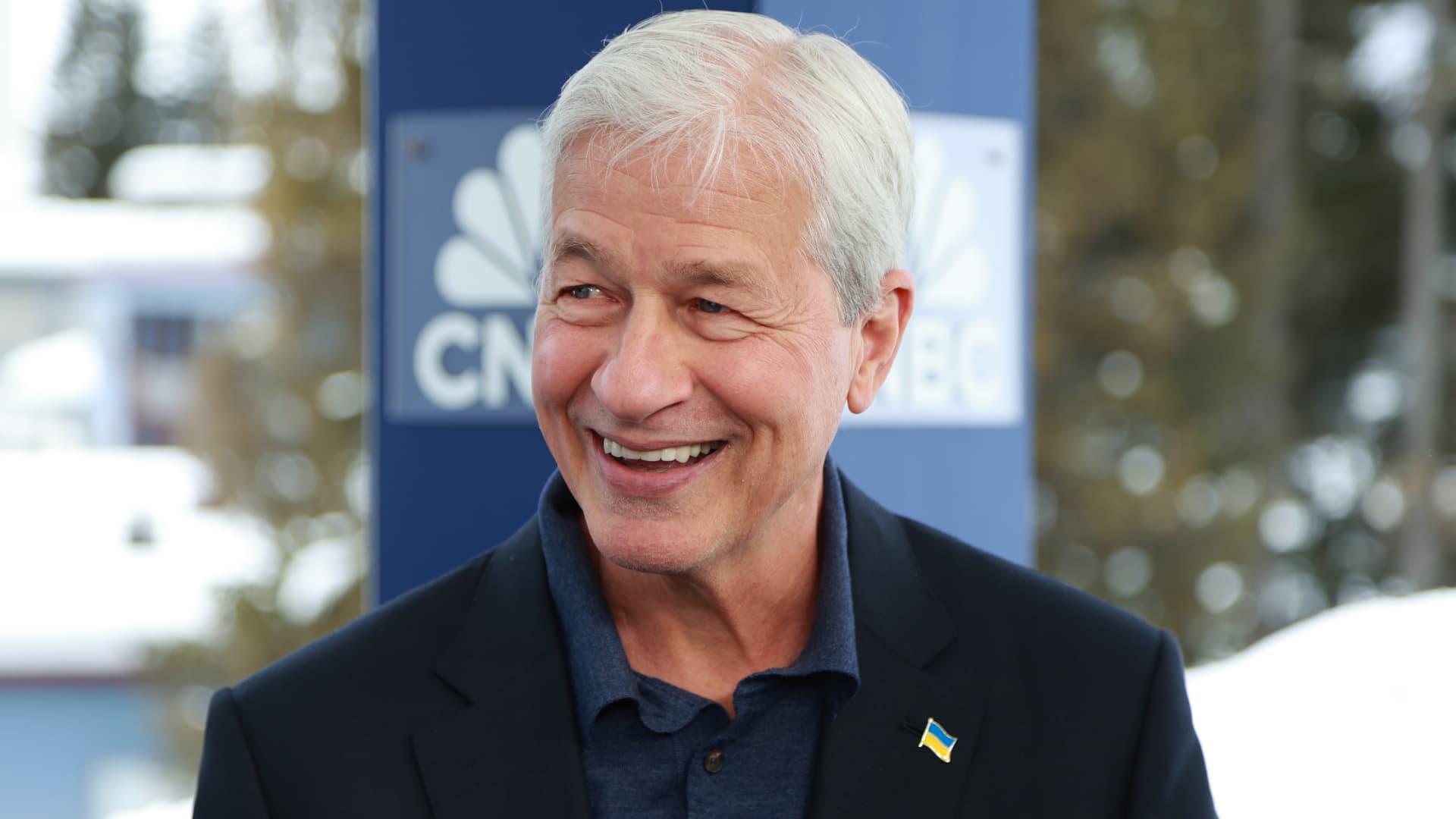

JPMorgan Chase President and CEO Jamie Dimon speaks on CNBC's “Squawk Box” during the World Economic Forum Annual Meeting in Davos, Switzerland on January 17, 2024.

Adam Garisi | CNBC

JP Morgan Chase On Friday, the company posted better-than-expected profits and revenue as trading revenue and credit costs were higher than expected.

Here's what the company reported:

- Earnings: $4.44 per share, compared to $4.11 expected by analysts surveyed by LSEG.

- Revenue: $42.55 billion vs. $41.85 billion expected.

The bank said its first quarter profit was $13.42 billion ($4.44 per share), up 6% from a year earlier, as it acquired First Republic during last year's regional banking crisis. contributed. Revenue rose 8% to $42.55 billion as the bank increased interest income due to higher interest rates and growth in its loan book.

America's largest banks by assets have weathered the interest rate environment well since the Federal Reserve began raising rates two years ago, but smaller peers have seen their profits come under pressure.

The industry is being forced to pay out deposits as customers move cash into higher-yielding financial products, squeezing margins. There are also growing concerns about rising losses on commercial loans, particularly for office buildings and apartment complexes, and an increase in credit card defaults.

However, major banks excellent There are many small-scale projects this quarter, and expectations for JP Morgan are high. Analysts believe the bank could raise its 2024 net interest income outlook as the Federal Reserve is forced to maintain interest rate levels amid stubborn inflation data.

Analysts will also want to know who the CEO is. jamie dimon Something to be said about the economy and industry efforts to oppose efforts to cap credit card fees and overdraft fees.

Industry investment banking fees are up 11% year-over-year, according to Dealogic, and Wall Street could provide some support this quarter.

JPMorgan stock has risen 15% this year, outpacing the KBW Bank Index's 3.9% rise.

wells fargo and citygroup Results are expected to be announced later Friday. goldman sachs, american bank and morgan stanley I will report next week.

This story is developing. Please check back for the latest information.

Summarize this content to 100 words JPMorgan Chase President and CEO Jamie Dimon speaks on CNBC's “Squawk Box” during the World Economic Forum Annual Meeting in Davos, Switzerland on January 17, 2024.Adam Garisi | CNBCJP Morgan Chase On Friday, the company posted better-than-expected profits and revenue as trading revenue and credit costs were higher than expected. Here's what the company reported:Earnings: $4.44 per share, compared to $4.11 expected by analysts surveyed by LSEG.Revenue: $42.55 billion vs. $41.85 billion expected.The bank said its first quarter profit was $13.42 billion ($4.44 per share), up 6% from a year earlier, as it acquired First Republic during last year's regional banking crisis. contributed. Revenue rose 8% to $42.55 billion as the bank increased interest income due to higher interest rates and growth in its loan book. America's largest banks by assets have weathered the interest rate environment well since the Federal Reserve began raising rates two years ago, but smaller peers have seen their profits come under pressure.The industry is being forced to pay out deposits as customers move cash into higher-yielding financial products, squeezing margins. There are also growing concerns about rising losses on commercial loans, particularly for office buildings and apartment complexes, and an increase in credit card defaults.However, major banks excellent There are many small-scale projects this quarter, and expectations for JP Morgan are high. Analysts believe the bank could raise its 2024 net interest income outlook as the Federal Reserve is forced to maintain interest rate levels amid stubborn inflation data.Analysts will also want to know who the CEO is. jamie dimon Something to be said about the economy and industry efforts to oppose efforts to cap credit card fees and overdraft fees.Industry investment banking fees are up 11% year-over-year, according to Dealogic, and Wall Street could provide some support this quarter.JPMorgan stock has risen 15% this year, outpacing the KBW Bank Index's 3.9% rise.wells fargo and citygroup Results are expected to be announced later Friday. goldman sachs, american bank and morgan stanley I will report next week. This story is developing. Please check back for the latest information.Don't miss exclusive information on CNBC PRO

https://www.cnbc.com/2024/04/12/jpmorgan-chase-jpm-earnings-q1-2024.html JPMorgan Chase (JPM) 2024 Q1 profit