JP Morgan (JPM) fintech deal buys Renovite to take on Stripe and Block

Front entrance of JP Morgan headquarters in New York City.

Eric McGregor | Lightrocket | Getty Images

JP Morgan Chase agreed to acquire a payments startup called Renovite to fend off threats from fintech companies, including stripes When block CNBC learned.

The bank, a major player in the global payments space, said its acquisition of Fremont, Calif.-based Renovite will accelerate its ability to roll out new services to its merchants.

JP Morgan is the world’s number one maximum Fast-growing start-ups such as Stripe and Block are outstripping providers of merchant services by transaction volume. Ranked up Thanks to the rapid growth of e-commerce and the spread of new payment methods in recent years. Merchant acquirers are key behind-the-scenes providers, enabling sellers to accept in-person and online payments and keep small amounts on each transaction.

despite making payments Juggernaut JP Morgan processes more than $9 trillion daily in several businesses, but JP Morgan’s merchant acquisition revenue lags in some e-commerce segments, and more than some fintech rivals. It also stalled last year because it offered fewer services, said Takis Georgakopoulos, global payments chief. told investors at the May meeting.

“Changing that image is the big story behind our investment,” vowed Georgakopoulos.

shopping fever

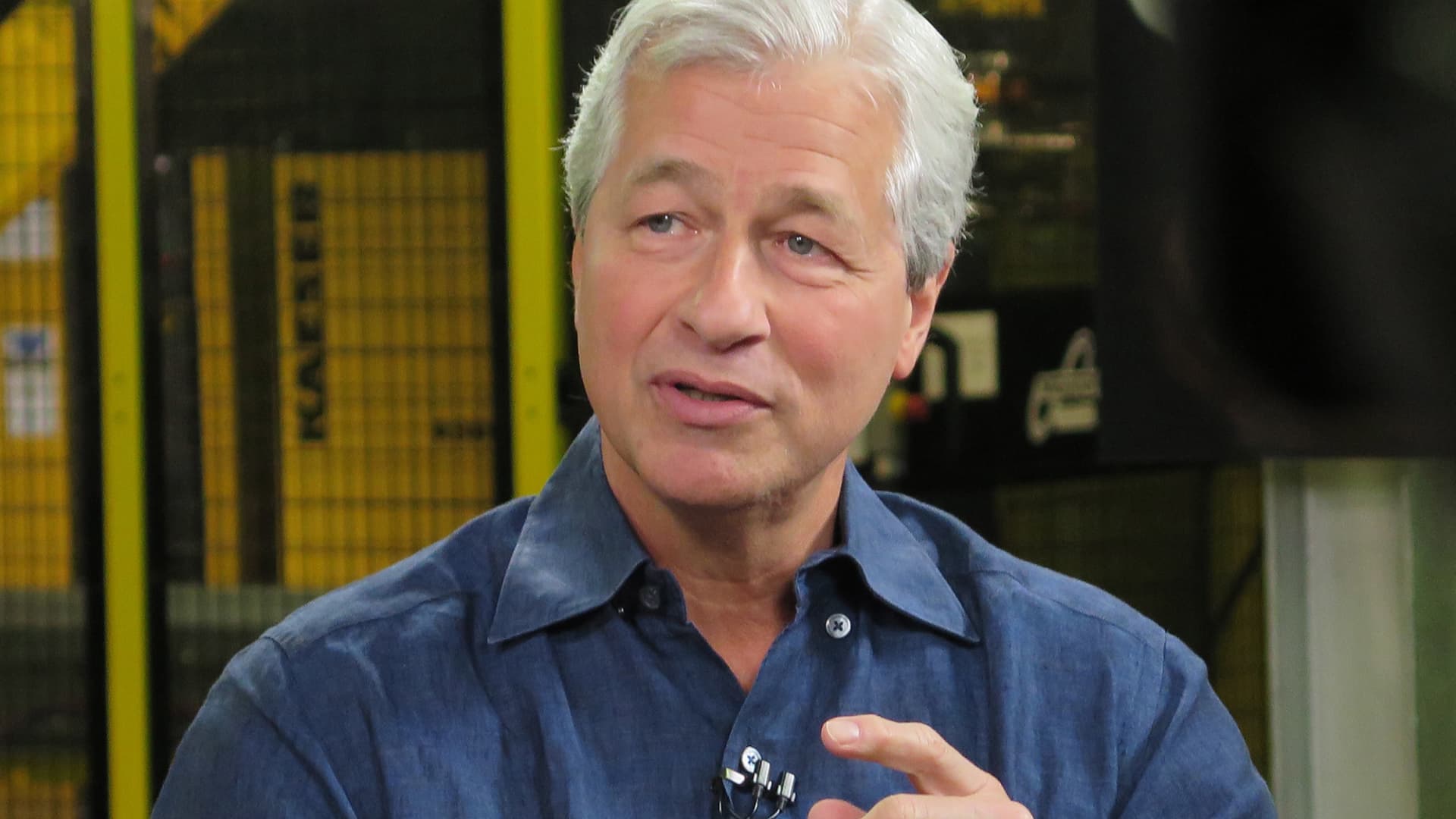

The Renovite acquisition, first reported by CNBC, The latest in a string of fintech deals Created under CEO Jamie Dimon. Since late 2020, JP Morgan has acquired at least five of his startups, from an ESG investment platform to a UK-based robo-advisor, in addition to a series of smaller fintech investments.

daemon many times raised the alarm On the threat fintech players pose to traditional banks, especially in the highly competitive payments game.

Fintech companies will process payments for merchants wedge To help them build their earned ecosystem Watery eye evaluation. They also generally Klarna I assure you.

Dimon was forced to defend his bank rising costs It’s pouring billions into technology this year as recession fears plunge its stocks 25%.

The deal with Renovite was signed by the longtime CEO on terms that could not be determined. Concern that he spends too much money About technology.

From trial to handover

JP Morgan did a trial run with Renovite as a vendor last fall, but was so impressed with the company’s offerings, especially the cloud-based switch that routes payments to various providers, that it decided to buy the company outright. It was determined. Mike BlandinaGlobal Head of Payment Technology for Banks.

Due to the plug-and-play nature of the Switch platform, JP Morgan can add new payment options in a fraction of the time it used to, because much less coding is required, he said in an interview.

“Our clients really value choice, and we want to offer them a variety of payment options. visa, MasterCard, as well as buy now, pay later, and more. ” Max Neukirchenthe company’s global head of payments and commerce solutions.

“The ability to enable these very country-specific payment methods also helps with geographic expansion, as we don’t have to spend a lot of time building local payment methods,” he added.

JP Morgan often partnered with fintech companies and was content to hold a relatively small stake, but the bank felt Renovite’s product was too important to not own. said Neukirchen.

The bank also wanted JP Morgan’s about 125 engineers in India and the UK to help with its product roadmap, he added.

https://www.cnbc.com/2022/09/12/jpmorgan-jpm-fintech-deal-to-acquire-renovite-to-battle-stripe-and-block.html JP Morgan (JPM) fintech deal buys Renovite to take on Stripe and Block